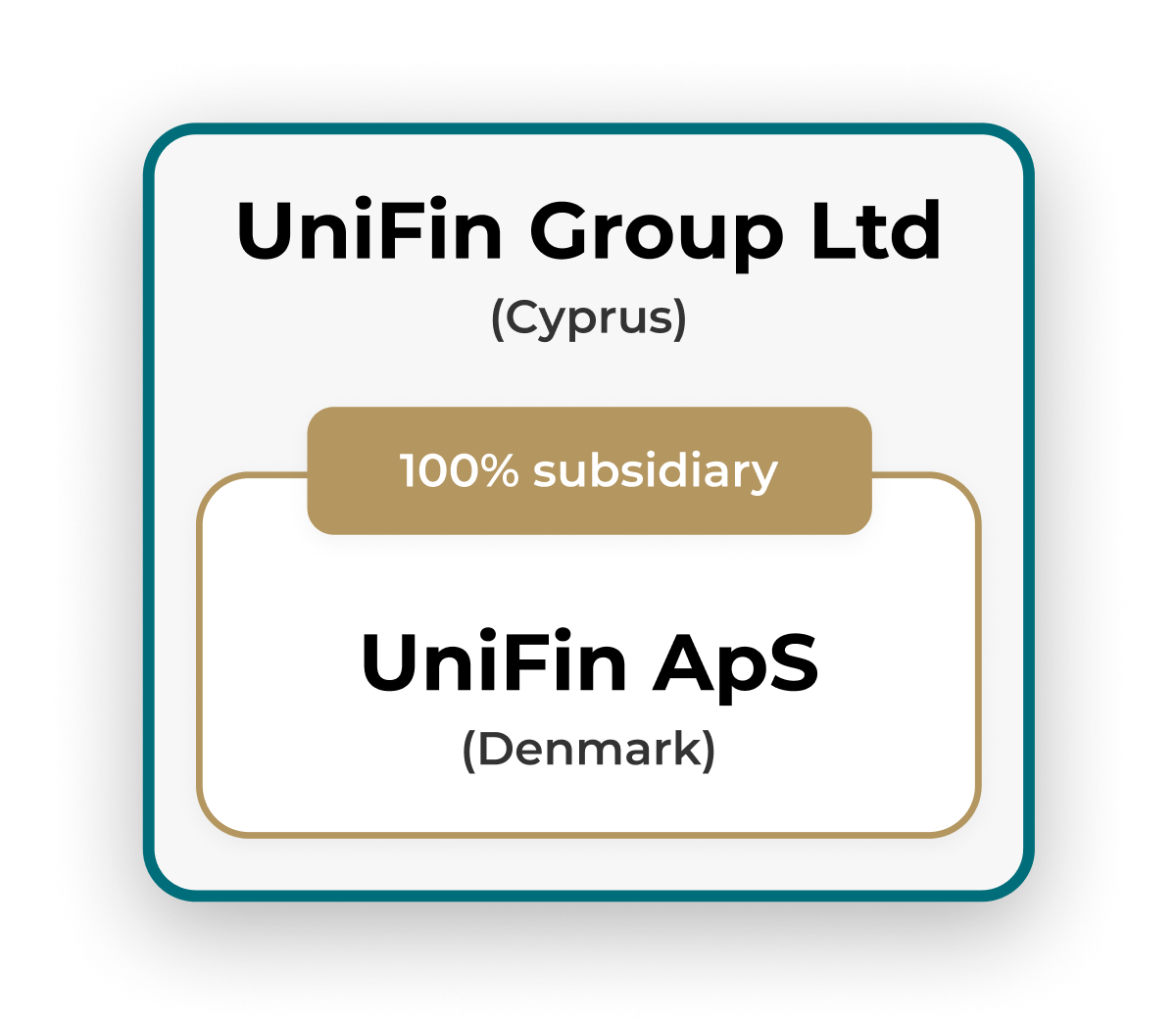

UniFin Group comprises a number of legal entities providing financial and payment services under national and international regulations:

UniFin ApS – registered in the Kingdom of Denmark, regulated by FTID 40333 Danish Financial Supervisory Authority (DFSA) and FTID 17511 VASP Danish Financial Supervisory Authority (DFSA).

UniFin Payment Ltd – registered in Canada, Business Number (BN) 764689220, licensed as a Money Services Business (MSB), supervised by FINTRAC, registration number C100000188.

Additional autonomous organizations and affiliated companies operate under the supervision of the Danish Financial Supervisory Authority (DFSA) and in accordance with European Union legislation: UniFin CryptoBank ApS, UniFin Exchange ApS, UniFin Venture Fund ApS, UniFin Commodity ApS.

All information presented on this website is for general informational purposes only. It:

- is not personalized investment advice,

- does not constitute an offer or solicitation to transact,

- should not be considered a guarantee of returns or capital preservation.

All investment and financial decisions are made by the client independently, taking into account their personal goals, financial situation, and risk assessment. UniFin Group is not liable for losses incurred as a result of using the information or services, except as expressly provided by law.

UniFin Group's services are not intended for residents of jurisdictions where their provision is contrary to local law or international sanctions. In particular, products and services are not available to residents of: the United States of America (USA), the Russian Federation, the Republic of Belarus, DPRK (North Korea), the Islamic Republic of Iran, Syria, Cuba, as well as territories under international sanctions (Crimea, LPR, DPR, and other restricted regions).

Access from such jurisdictions may be restricted or blocked automatically.

Client funds are protected through:

- asset segregation,

- custody in regulated financial institutions,

- compliance with DFSA, FINTRAC, and MiCA/ESMA regulations.

Nevertheless, UniFin Group emphasizes that no measures can completely eliminate market, operational, and legal risks, including but not limited to: price fluctuations, counterparty risks, regulatory changes, and technological failures.